Morgan Stanley Boosts Stake in Bitcoin-Laden MicroStrategy to 10.9%

- The financial giant boosted its stake by almost 650,000 shares since the end of Q3.

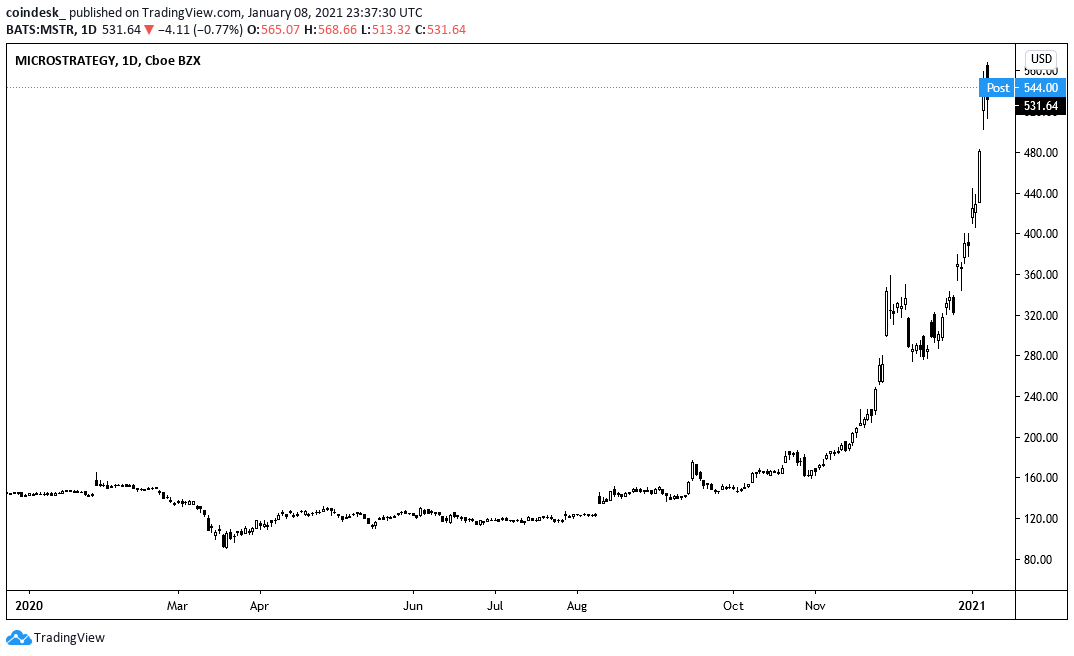

- The shares of MicroStrategy, a relatively little known business intelligence firm prior to its massive investment in the leading cryptocurrency, have soared 330% since the company bought its first bitcoin on Aug. 11, 2020, rising from $123.80 to $539.57.

- As illustrated in the chart below, before buying its first bitcoin, MicroStrategy's share performance left something to be desired, having fallen 13% from Jan. 2, 2020, through Aug. 10, 2020.

- Given MicroStrategy's shares are largely tracking the price of bitcoin, which is up more than 40% this year following a 300% gain in 2020, it's likely Morgan Stanley views its investment as a way to benefit from bitcoin's historic run without actually being a HODLer.

MicroStrategy's decision to load up on bitcoin has been very very good for shareholders.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.